Natural Gas Market Update – December 1, 2025

- Tony Zelinski

- Dec 1, 2025

- 2 min read

It’s a new week, and the opening tone is cautious: winter demand is building, storage is comfortable, and production remains high. Price action is sensitive to near-term weather and LNG flow timing.

Front-month wrap: The December contract ended last week soft amid “lofty” production and expectations for a bearish storage print, even as cash prices firmed on localized demand. Early-week trade is watching whether firmer spot strength spills into futures or fades with milder forecasts.

Seasonal context: The EIA expects the Henry Hub spot price to average about $3.90 over the Nov–Mar winter, with a peak near $4.25 in January, reflecting typical winter heating demand plus incremental LNG pull.

Fundamentals snapshot

Storage: U.S. inventories exited October roughly in line with last year and about 4% above the five‑year average, providing a cushion into early winter and dampening volatility on shoulder‑season days.

Production: Output remains elevated, a key driver of the softer December finish; sustained high production continues to cap rallies unless colder weather materializes decisively.

Consumption outlook: EIA projects lower residential/commercial burn this winter versus last year due to a warmer weather forecast, with those sectors averaging 36.5 Bcf/d (−5% y/y, −2% vs five‑year).

LNG and exports

Near‑term capacity: Plaquemines LNG received approval to introduce gas into Block 17, bringing remaining capacity online sooner than previously expected; EIA raised its 4Q25 LNG export forecast by ~3% on this timing.

2026 pipeline: Additional capacity from Golden Pass (Trains 1–2) and Corpus Christi Stage 3 (Blocks 4–7) is slated to add ~2.1 Bcf/d by end‑2026, shaping medium‑term balances and winter price averages next year.

Weather and risk drivers

Weather path: A warmer‑than‑last‑winter baseline tempers early‑season demand. Price upside hinges on sustained below‑normal cold shots, pipeline constraints, or stronger‑than‑modeled LNG flows.

Key watchpoints:

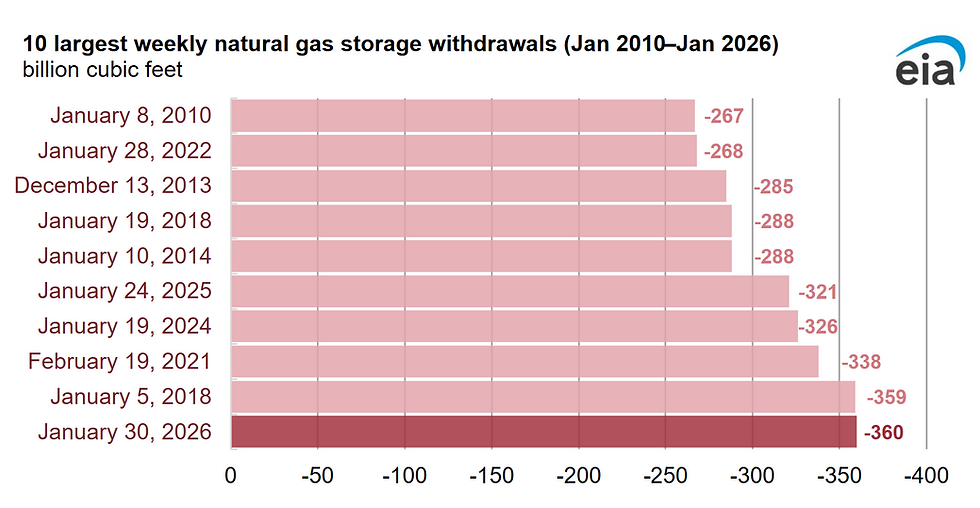

Weekly EIA storage prints: Any surprise draws vs expectations could reprice the curve.

Production trajectory: Signs of moderation, freeze‑offs, or maintenance impacts would tighten balances.

Cash vs futures spread: Persistent cash strength could pull prompt higher if weather turns.

Global LNG: European/Asian price signals and U.S. terminal ramp rates are potential catalysts.

Strategic takeaways

Hedging posture:

Short‑term buyers: Layer modest volumes on dips toward seasonal averages, keeping flexibility for weather‑driven spikes.

Q1 exposure: Consider staggered coverage around January peak expectations; avoid over‑hedging if forecasts stay mild.

Basis and operations: Monitor regional basis where cash firmed; localized cold and pipeline dynamics can move delivered costs independent of Henry Hub.

Communications: Emphasize inventory comfort and LNG timing as balance‑of‑risks. Highlight that price resilience likely requires colder and longer‑lasting patterns than currently forecast

Would you like a review of your facility's energy plan? We are here to help!

Comments