📉 EIA Natural Gas Storage Report – Week Ending February 6, 2026

- Tony Zelinski

- 2 hours ago

- 2 min read

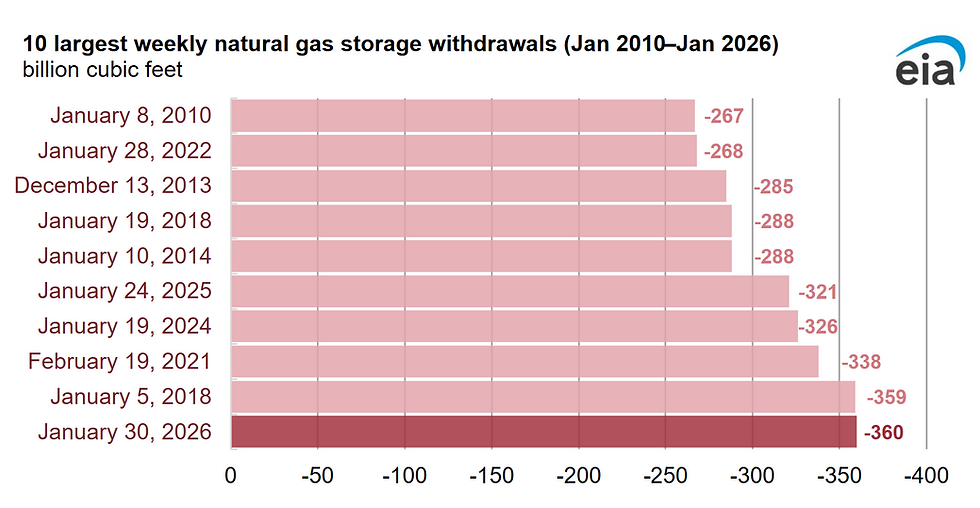

The EIA reported a 249 Bcf withdrawal from U.S. natural gas storage for the week ending February 6, 2026, reflecting another week of intense heating demand across the Lower 48. This marks the second consecutive triple‑digit draw following last week’s record‑setting 360 Bcf withdrawal, underscoring the severity of the ongoing Arctic outbreak.

249 Bcf Withdrawal Tightens Inventories as Extreme Cold Drives Demand

Total working gas now stands at 2,214 Bcf, placing inventories:

• 97 Bcf below last year at this time

• 130 Bcf below the five‑year average of 2,344 Bcf

• Still within the five‑year historical range, but tightening rapidly

The deficit to both last year and the five‑year average highlights how quickly the storage cushion has eroded during this extreme cold stretch.

📍 Regional Breakdown

The Midwest and South Central regions led the withdrawals, consistent with the deepest and most persistent cold anomalies. The Pacific region posted a slight build, reflecting milder conditions and improved hydro/wind output.

🌡️ Weather & Demand Drivers

The withdrawal reflects a perfect storm of winter fundamentals:

• Extreme cold across the central and eastern U.S.

• Surging residential/commercial heating demand

• Elevated power burn, with gas‑fired generation compensating for reduced wind output

• Strong LNG feedgas flows, keeping baseline demand high

This combination continues to push withdrawals well above seasonal norms.

⚙️ Supply Context

While production remains strong by historical standards, freeze‑offs and operational constraints have limited output in key basins. Combined with record‑level heating demand, the supply‑demand balance has tightened sharply.

📈 Market Implications

With inventories now below both last year and the five‑year average, the market is entering a more structurally bullish phase. Traders are increasingly focused on:

• The duration of the Arctic pattern

• Potential freeze‑off impacts on production

• Whether LNG demand remains elevated

• The pace of withdrawals through late February

The back‑to‑back massive draws have injected fresh volatility into the curve, and risk premiums are rising accordingly.

🧭 Strategic Takeaways

• 249 Bcf withdrawal confirms ongoing extreme winter tightness

• Storage deficits are widening, shifting the market into a more bullish posture

• Weather remains the dominant driver, with additional large draws possible if cold persists

• Volatility will remain elevated, especially if production disruptions continue

📌 Bottom Line

The February 6 report reinforces a rapidly tightening natural gas market. With inventories now materially below normal and winter weather still in control, the next several weeks will be critical in determining end‑of‑season storage levels and shaping price direction into spring.

#NaturalGas #EIA #GasStorage #EnergyMarkets #Commodities #WinterOutlook #HenryHub #LNG #WeatherRisk #NatGas

Sources:

Natural Gas Futures

Read more: EIA

Have you reviewed your facility's Energy plan yet?

What are you waiting for?

We are here to help...

Comments